Discover Family Friendly Locations Around The World, On The Only Global Travel App Designed For Parents

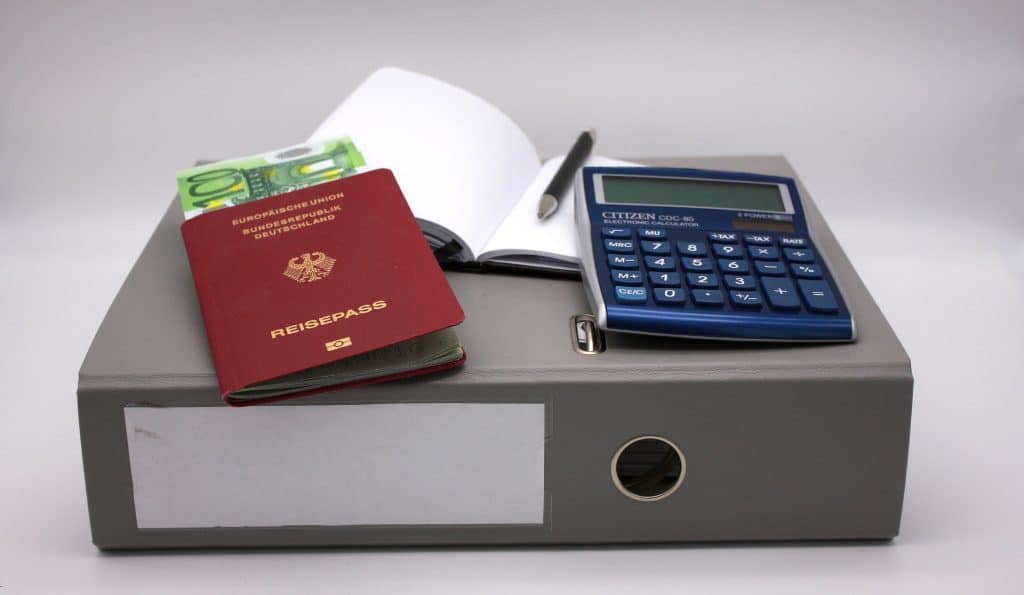

You are setting out on your next family vacation but there’s no telling when an interruption may pop up and it pays to be prepared for things like medical emergencies, especially with kids.

The best way to protect your family against all travel complications is by buying travel insurance. If you purchase travel coverage, you can rest assured that most unplanned expenses and travel delays will not impact your trip.

But what exactly does travel insurance policy cover, and is it worth the investment?

Our team gathered info about different types of coverage and benefits of taking a family travel insurance policy, so you can be in the know.

1 in 6 travelers encounter an issue while traveling, with 37% of all claims being related to trip delays and 15-37% of short-term international travelers experiencing a health problem during a trip. (source: Tripinsurance.com).

In many cases, when something goes wrong, even something small like a loss of luggage, it can affect the rest of the vacation, especially if a family travels with a budget in mind. So getting Insurance will help keep these mishaps from spiraling out of control financially.

If you thought travel plans are not worthy, you are not alone. Only “38% of travelers purchase insurance for their trip” according to Business insider.

Just know that what you pay for most travel insurance plans versus the cost of out of pocket expenses is often self explanatory on why many seasoned traveling families choose to get coverage.

This content contains affiliate links, if a purchase or booking is made, we may earn a commission. This does not affect our content integrity nor decision to add or remove a location from our editorial content.

Although travel insurance is not a necessity, be prepared to deal with lost money, lost items, and delayed flights without much change of reimbursement.

To remedy the lack of coverage, families often book refundable tickets and rely on their credit card insurance coverage to help with any unforeseen trip cost.

The truth is that refundable rates are 4X more expensive than the starting rate and apply per family member, while many travel insurance companies have a fixed rate per trip and often cost less than the premium rate. And that is just covering your flight! Then you have to get a refundable rate for all your lodging as well.

If you do choose to travel without travel insurance, make sure you calculate the extra fees versus the cost of coverage and have some money set aside to handle expenses if you deal with delays, cancellations, medical issues, etc for all travelers.

Regarding the need for medical insurance, this study published by the UK government, shows some average costs related to issues applicable to traveling families.

If you fall in Spain and break your leg, you will need hospital treatment and flights | £15, 000 |

If you have a quad bike accident in Greece, and you need surgery and flights back to the UK | £30, 000 |

If you have a stomach bug or infection treated in a hospital in the USA and need new return flights | £100, 000 |

Source: gov.uk

So, as any other insurance in your life, make sure you weigh the risks and factor in costs before deciding against a travel policy.

Our primary focus is on showcasing small, local, inclusive, and environmentally responsible businesses, allowing you to use your tourism $ positively while having fun with your kids…

While credit card travel insurance offers a layer of protection for families, it is always recommended to read the fine print and understand how to approach this coverage with caution due to its limitations.

Most credit card companies will only cover your family trips’ expenses that were put on said credit card!

For instance, if you use an airline credit card to book a flight and get rewards, that flight and all potential expenses (i.e. baggage loss), may not be covered under your primary credit card insurance plan.

When it comes to baggage loss and breakage, for instance, many credit card travel insurance plans cover belongings with limitations and conditions that the airline does not offer compensation. This can leave families underinsured in case of significant losses.

Medical insurance coverage can also be limited. Travel insurance benefits under credit card policies, typically cover only emergency medical expenses and might not encompass pre-existing conditions or specific medical needs, which could leave families with substantial out-of-pocket costs in a medical crisis during international travel.

Besides medical insurance, the most important things to look at when you plan your family vacations is trip cancellation insurance. While it sounds like credit card companies may advertise it in their promotional content, the medical coverage is usually restricted to specific, predefined scenarios. Many common causes of trip cancellation, such as family emergencies or certain natural disasters, might not be covered under those plans. This can lead to a false sense of security and unexpected financial burdens. Therefore, it is imperative for families to thoroughly review all benefits and understand the limitations and exclusions of their credit card travel insurance policy to ensure they are not caught off guard during their travels.

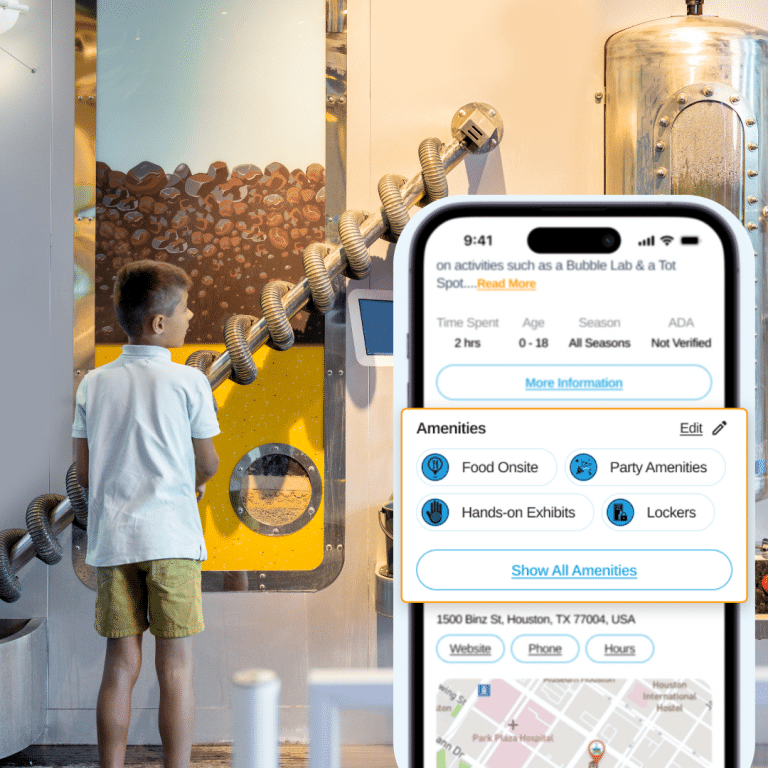

A world interactive map to find fun things to do with kids, on all devices.

Filter travel inspirations by your kid’s age, interests and more…

Join a private and safe community with kid-friendliness scores and insider tips.

Share photos of your trips with an identity protection feature.

Get custom recommendations based on your travel profile, create bucket-lists and export your family friendly itinerary onto google map for easy planning.

Of course, when you’re trying to keep your family trip covered, you shouldn’t have to settle for anything less than the best. While there’s no one-size-fits-all insurance policy, some providers are better than others. To get you started, we took a look at a few companies with the best travel insurance plans.

Faye Travel Insurance, has been selected by the GoWhee members as a favorite travel insurance for families because of its ease in selecting a plan, its interactive app, clearly defined benefits, and ability to customize the plan, as well as its around the clock concierge-like services after enrollment.

Faye covers many aspects of your trip, from your family’s health to items that could get damaged like strollers, car seats, and more…, and it offers 24/7 customer support. They have policies for most kinds of trips from domestic to international travel and even offer coverage for cruises.

We also recommend looking at their supplementary coverage for things like vacation rental protection, adventure sports coverage (great for upcoming ski trips or hikes), car rental care, and pet care.

But what makes them our top selection is their user-friendly platform, where you can easily sign up in about 60 seconds, choose the best policy for your family, access their concierge services like weather and emergency contact info for your destinations, and more. The same platform makes it a breeze to process claims by answering a few questions and as parents, we particularly appreciate their telemedicine service!

Check out our interview with their team, to answer many of the questions about travel insurance.

Allianz Travel, is a leader in the family travel insurance space and offers comprehensive travel insurance at excellent prices. Policies with Allianz typically offer medical coverage, travel delays, lost property, and the like. It’s an excellent choice for families with young children, as any family member under 17 years old can be included in your coverage for free.

In addition, you can choose between policies for single or multiple trips, so if you don’t travel frequently, you don’t need to invest in a plan you’ll only use a few times. However, keep in mind that there are no coverage options if you need to cancel your trip spontaneously, so you’ll only be reimbursed if you cancel for reasons specifically covered under your policy.

For families that love to travel, we recommend the AllTrips Prime package, which offers families $3,000 in trip cancellation and interruption coverage per person, and includes medical emergency, emergency transportation, baggage loss, and rental car damage coverage.

Many frequent travelers swear by AIG’s travel insurance policies, and for good reason. With three separately-priced policy options, benefits cover your family as much or as little as you feel is necessary. Regardless of your plan, however, you can expect service that’s a cut above the competition, allowing you to have peace of mind on your family vacation, no matter what happens.

We recommend the Preferred plan policy, which offers 100% insured trip costs, 150% insured trip interruption coverage, plus missed connection, baggage loss and delay, emergency evacuation coverage, and much more.

You can never be too prepared when going on vacation, and AXA Travel Insurance plans allow you to plan for just about anything. AXA’s plans boast high reimbursement rates for medical emergencies, lost time, and quite possibly the best lost-luggage coverage you’ll be able to find.

In addition, you can choose to add an insurance policy covering cancellation for any reason, meaning that you and your family will be covered in even the most unexpected scenarios. Best of all, their plans include a concierge service, allowing you to enjoy your family vacation to the fullest.

We recommend the Gold Plan, which offers 100% trip cancellation protection, 150% trip disruption coverage, and all the basics needed for travelers.

Know someone headed on a trip soon? Share this guide with them to make sure they’re covered! And head on over to the GoWhee app for more travel tips.

Did you find this article about family travel insurance helpful? Make sure your friends and family know about this too and share this article by clicking one of the buttons below.

*Disclaimer: The content of this blog post is for informational purposes only and does not constitute professional travel insurance advice. The opinions expressed herein are solely those of the author and should not be considered as a substitute for professional advice. It is always recommended to consult with a qualified travel insurance professional for specific advice related to your personal circumstances

Real-life kids safety tips for your next vacation. From packing smart to staying connected. Here are ways to keep your family safe, and be prepared.

Looking for a theme park alternative this summer? Discover why Mont-Tremblant is the family resort in Québec that offers adventure, calm, and flexibility without the chaos of all-inclusive crowds or packed amusement parks.

This summer you could experience something new on a budget at Lava hot springs in Idaho. Enjoy the small town charm, mineral hot pools and a water park complex.

Plan your visit to the Pirate Ship Playground at the Diana Memorial Playground, one of Kensington Gardens’ top family attractions. Explore play sculptures, a sensory trail, and the iconic wooden pirate ship.Plan your visit to the Pirate Ship Playground at the Diana Memorial Playground, one of Kensington Gardens’ top family attractions. Explore play sculptures, a sensory trail, and the iconic wooden pirate ship.

Seasoned traveling parents from GoWhee, share their favorite tips to plan a family vacation on a budget, without cutting down on fun experiences.

Experience the unique set up at the Victoria Bug Zoo in downtown Victoria, BC. Recommended for it’s educational and kid-friendly exhibits.

The only global travel app designed for family travel, using crowd sourced data from parents around the world.

Copyrights@2024 Gowhee Technologies. All Rights Reserved.

Preview

“All the insiders’ tips the travel industry doesn’t want you to know!”